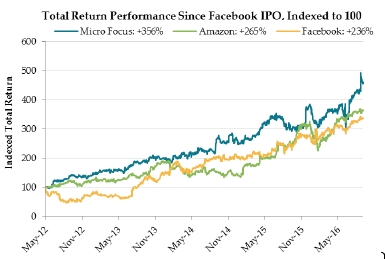

Turns out, it’s possible to be a mature tech company that doesn’t radically grow revenue and still post commendable returns for shareholders.

It’s the case with UK-based Micro Focus, whose stock has significantly outperformed both Facebook and Amazon since Facebook’s IPO. Micro Focus’s success isn’t because it has ploughed hard-earned profits into speculative new products or acquired a faster-growing competitor. Instead, Micro Focus inked solid returns efficiently running its business and smartly acquiring (and integrating) other slow-growers.

The latest chapter in the Micro Focus success story unfolded earlier this month when Micro Focus said it would buy Hewlett Packard Enterprise’s software business for $8.8 billion. Both Micro Focus and HPE’s software business provide software infrastructure – the virtual brick and mortar that powers everyday IT. This is not a dynamic segment of the tech industry. Micro Focus has had sluggish recurring revenue growth over the recent years. The target? Even worse: HPE’s software business has been shrinking. Yet, the market embraced the acquisition, and Micro Focus saw its stock jump after the announcement.

The market embrace of Micro Focus runs counter to the conventional wisdom well-captured in a 2014 McKinsey & Company report titled “Grow fast or die slow”. The report paints a bleak picture for tech companies that don’t grow at extraordinarily high rates. “If a health-care company grew at 20 percent annually, its managers and investors would be happy,” the report says. “If a software company grows at that rate, it has a 92 percent chance of ceasing to exist within a few years.”

Many tech companies follow this standard advice and sacrifice profits for revenue in early stages – and this makes sense. Over the long term, however, this approach bears fruit only if companies fall into one of two categories. Either they are on their way to becoming the only player – or the dominant one – in their market or category and can eventually capitalize on their position (e.g. Amazon). Or they are already profitable but choosing to eat into profits for a while to reinvest in growth, in which case they can stop spending at any time (e.g. Netflix).

Once companies mature, the model adjusts. As McKinsey notes, “When companies reach $4 billion in revenues or more margins become more important to value multiples.” The trouble is companies often embrace McKinsey’s growth strategy even though their circumstances do not warrant it. Similarly, many tech companies feel compelled to pursue a growth strategy long after their core markets slow and mature.

There’s no shortage of examples of companies making this mistake.

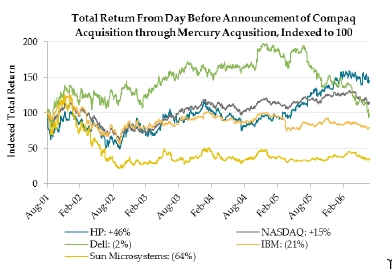

Hewlett Packard merged with Compaq in 2001 in a deal driven primarily by cost rationalization. The markets initially rejected that deal (Sun Microsystems CEO Scott McNealy famously and openly mocked it as the collision of two garbage trucks), but over roughly the next five years embraced it; HP’s stock price rose roughly 50% versus 15% for the NASDAQ over that period and beat Dell, IBM and Sun Microsystems. (Note: Foros founder and CEO Jean Manas was an advisor to HP on this deal.)

Shortly after this success, HP went on an expensive buying spree to stimulate growth starting with buying Mercury Interactive in 2006. This quest ended badly. The company ultimately wasted $10 billion on Autonomy Corporation, an ill-fated growth acquisition in 2011. HP has been seeking to undo this series of growth acquisitions ever since.

Dell has a similar story. It chased growth for years before stumbling badly and ultimately being taken private. Result? Dell is now focused on “consolidating mergers”, acquiring EMC, not just for growth, but for greater market heft and a bigger footprint from which to derive synergy.

The examples above suggest that growth at any cost can’t always be right. The mistake, in part, lies in how people determine the value of tech companies in the first place. People believe that the tech sector is “unique” when it comes to valuation, and often emphasize revenue multiples and growth rates over other important financial metrics. In this simplistic approach, the greater the revenue growth the greater the revenue multiple the company deserves relative to others. (And when tech companies are in favor, this multiple can be skewed higher. This is usually a symptom of the sector diverging from fundamental valuations; as previous cycles have shown, such divergence ends with a convergence back to fundamental valuation, which many investors experience as a correction or a crash.)

This conviction ignores another key variable that ultimately affects the value of a firm: the level of investment required to achieve growth. If the investment required is too high, stretching for growth can be value-destroying. Further, as companies mature, the market will transition from valuing them based on revenue to an earnings multiple. They are chasing growth while the market is looking for profits.

The key question, then, is what is the algorithm that guides decision-making around growth and earnings? Foros Perspectives has found a helpful framework in old-fashioned discounted cash flow (DCF) valuations. When trying to determine the value of a company using a DCF, investors typically consider three moving pieces: the company’s growth rate, its cash flow margin, and its cost of capital (i.e. discount rate), which reflects the price a company pays to fund its business with equity and debt.

The McKinsey report puts the spotlight on the first variable, but does not provide a real framework for resolving the tradeoff.

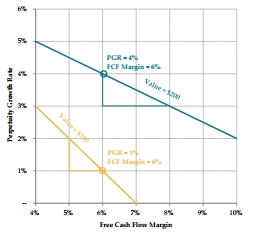

Foros Perspectives has looked closely at the application of DCF analyses (see Appendix) to determine the relative relationship between growth rates and cash flow margins on the ultimate value of a firm. The analysis shows that the two are more or less mathematically equal for a company growing roughly at inflation and with a 7% cost of capital, which is broadly in line with the market. In other words, for every percentage point that a company can increase its cash flow margin, long term growth can fall by as much and the overall value of the company will roughly stay the same. Or stated in the inverse, a company can justify an investment in growth only if a 1% decline in margins to invest for growth produces a 1% increase in the long-term growth rate (as can be seen in the Appendix, this tradeoff rate varies at different starting growth and margin levels). It is important to note that the applicable growth rate is not some short term growth rate, but rather the company’s sustainable perpetuity growth rate.

Additionally, companies technically are always better with a lower cost of capital, and higher growth companies tend to have higher costs of capital than more mature, slower-growing companies. Tech companies with growth less than 10% have an average cost of capital that is about 2 percentage points (200 basis points) higher than the average cost of capital for companies with growth rates greater than 20%, based on data of approximately 200 public US tech companies. Even if a company can justify lowering margins for accelerated growth, the increased cost of capital associated with higher growth companies may mute some of that benefit. This is not to say growth acquisitions by mature companies cannot work, rather that the correct metrics are essential in the decision process.

That brings us back to Micro Focus and HPE’s software business. Rather than lunge after a faster growing business, Micro Focus plans to increase shareholder value by running HPE’s software business, whose margins are less than half as high as Micro Focus’s 46%, more efficiently. If it successfully does this, and ekes out the $80 million in cost savings that it has estimated, the company will more than double HPE’s EBITDA contribution. This increased EBITDA, after tax, is expected to flow directly to the bottom line – another $1.68 of earnings per share, according to the company. Even at a modest multiple, that’s something for shareholders to cheer.

There’s no guarantee Micro Focus will succeed. In application – just like every other deal – the moving parts can go in unpredicted directions due to missteps in execution. Nevertheless strong shareholder returns over the last several years suggest “Grow fast or die” is too fatalistic. Perhaps tech company CEOs should instead think “Grow shareholder value, thoughtfully.” As Micro Focus shows, another path exists.

APPENDIX: A Primer on DCF Valuation

In a discounted cash flow model, the value of a firm is calculated by discounting to the present, using a firm’s cost of capital, its projected cash flows for a certain number of years and its so-called terminal value at the end of the projection period. The terminal value is represented by the value of its future cash flows, using the formula Value (V) = Revenue (R) times Cash Flow Margin (f) divided by the difference between Cost of Capital (WACC) and Perpetuity Growth Rate (g) or

V = R*f/(WACC-g)

For purposes of the analysis, the model can be simplified to eliminate the need to project interim year cash flows: the terminal value is calculated today based on the upcoming year’s revenue, cash flow and perpetuity growth assumptions. It is important to note that the growth in question is the best estimate of a company’s perpetuity growth rate which will be a function of both near and longer term growth. The use of the DCF (discounted cash flow) methodology requires that the relevant margin be the cash flow margin, rather than a non-cash based form of profitability.

Here is an example: we assume Firm A has $100 of revenue with 6% cash flow margins, a 7% cost of capital(1), and a 1% perpetuity growth rate. The value of Firm A is $100.

V = $100*0.06/(0.07-0.01) = $6/0.06 = $100

If Firm A increased its cash flow margin by 1% (100 basis points) while reducing its growth outlook by 1% (100 basis points), the value of Firm A would still be $100. Similarly, if Firm A reduced its cash flow margin by 1% (100 basis points) to improve its growth profile by 1% (100 basis points), the value would again be $100. In this example, there is a clear one-for-one trade-off between growth and margin.

However, the trade-off is not always one-for-one. Assume Firm B is identical to Firm A except that it expects to grow 4% into perpetuity. The value of this firm is $200. However, the trade-off between growth and margin to be indifferent from a value perspective is not one-to-one, but rather two-to-one. Increasing growth by 100 basis points and decreasing margins by 200 basis points is value-neutral.

Note that this is just one way of thinking about the algorithm. The chart to the right shows the growth vs. margin algorithm at various cash flow margins and perpetuity growth rates for two different firms that have a 7% cost of capital and $100 of revenue, one that is a faster-grower worth $200 and another that is a slower-grower worth $100. Of course, there are more nuanced and sophisticated versions, but this analytical framework provides a good starting point.

Footnotes:

(1) See Foros Perspectives “When It Pays to Pay Taxes” for detailed calculation.