There is a new accounting standard coming to town in 2017. ASC 606 is a revenue recognition standard that will impact the software industry, particularly companies that offer on-premise subscription licenses over a finite, multi-year period. In short, revenues related to these contracts were previously recognized ratably over the length of the contract but now may be accelerated under ASC 606. This new standard is unlikely to have a material impact on how affected software companies operate and conduct business, but it will lead to quarterly fluctuations in revenue and, subsequently, earnings due to the concentrated nature of the enterprise software sales cycle. This has implications on valuation methods for software companies.

The impact of ASC 606 is essentially a matter of timing for when revenue hits the income statement, but cash flow is largely unchanged because contract payment terms will remain the same. There may be some impact to quarterly cash flow given the potential for acceleration of tax payments (GAAP financials are the point of departure for computing taxes) and administrative costs associated with implementing ASC 606.

With quarterly volatility in revenue and therefore earnings, comparing the relative growth and profitability profiles of similar companies will become increasingly difficult and less relevant. Citing multiples of trailing EBITDA or earnings from recent transactions (particularly those that precede the adoption of ASC 606) may no longer be useful. This increased complexity and volatility will compel investors and acquirers to focus on metrics that are less susceptible to change under ASC 606, namely cash flows. Buyers are on firmer ground using cash-flow based valuations. We articulated this view in a prior Foros Perspective: Redefining Value in Tech. At a time when public companies increasingly redefine their earnings using non-GAAP adjustments, a shift in valuation methodology towards more fundamental metrics, such as cash flow generation is a welcome change.

The coming accounting changes and the staggered adoption timeframe (2017 for public companies and 2018 for private companies) will require software company buyers and sellers to make process changes and to conduct additional diligence when considering and executing transactions over the next two years. Below is an overview of ASC 606 focusing on issues to consider in the context of software M&A. It also includes simple examples of the potential impact on financial statements depending on a company’s licensing/service model and discusses changes in accounting for sales force compensation.

ASC 606 – A Primer

ASC 606 is a new, mandatory accounting standard for revenue recognition under US GAAP that will impact many industries, with a particularly significant effect on the software sector as it replaces existing guidance that is particularly relevant to the software sector. Public entities are required to implement the new guidance for periods ending after December 15, 2017, while non-public entities have an additional year, and must adopt for periods ending after December 15, 2018. These changes and the staggered adoption timeframe will require software company buyers and sellers to make process changes and to conduct additional diligence when considering and executing transactions over the next two years.

The precise effect of the changes will vary for each company depending on the types of contracts it uses to sell software and services. The greatest change is expected for those software vendors offering on-premise subscription licenses for specific multi-year terms, for which revenue is recognized ratably under current standards and may be accelerated under ASC 606. ASC 606 may also have cash flow effects as acceleration of revenue can cause an acceleration of income tax payments and there will be adoption and ongoing compliance costs.

While each company and transaction is different, what follows here are a few key items to focus on during the transition to ASC 606.

Accounting Effects:

- Changes to Revenue Recognition: Possible acceleration of revenue booking and follow-on financial effects, including near-term increases in EBITDA, increases in year-to-year volatility, and a decrease in deferred revenue balances

- Changes to Treatment of Commissions: Capitalization of commissions in lieu of upfront expense treatment

- One-Time Adjustments: One-time adjustments at the time of transition, either a restatement of historical financials and a one-time cumulative charge for change in accounting method

- Better Positioned Strategic Acquirers: Strategic acquirers that have been disadvantaged by the need to present near-term EPS accretion from M&A may be better positioned going forward as growth-stage targets may have a more front-loaded EBITDA profile, a smaller deferred revenue balance, and therefore a smaller post-acquisition deferred revenue haircut. These acquirers may also be able to achieve faster revenue increases after an acquisition via go-to-market synergy, since subscription bookings would be recognized as up-front revenue, improving near-term revenue and EPS. Financial sponsors who have benefited from the absence of such strategic acquirers, particularly for on-premise subscription license software companies, may face more competition.

Comparability:

- Historical Trading and Transaction Multiples: Changes in revenue recognition and commissions are likely to make comparability to historical trading and transaction multiples difficult

- More Judgment Required in Applying New Standard: Significantly more judgment is required by companies in applying ASC 606 and this may lead to less comparability between companies and complications when the buyers move the target businesses to their books and must apply consistent treatment

- Public/Private Staggered Adoption Timing: Public buyers may find private targets are a year behind in adoption due to the different adoption timing requirements leading to a need to re-base the target’s financials under ASC 606. This may also lead to substantial incremental acquisition integration work

- Convergence of US and International Standards: US GAAP and IFRS changes are expected to synchronize international and US standards

Impacts on Other Financial Measures:

- Debt Covenants: New accounting standards may cause artificial achievement of covenant compliance or artificial misses. Agreements may need to be amended. There could be an effect on permitted leverage (positive or negative) for existing and new loans as reported EBITDA is altered. Showing pro-forma covenant compliance is required under many lending agreements as a condition to an acquisition

- Management Compensation Plans: New accounting standards may cause artificial achievement of hurdles or artificial misses. Plans may need to be amended and rebased

- Business Partner or Other Third Party Sales Agreements: New accounting standards may cause artificial achievement of hurdles or artificial misses. Business partner agreements may need to be amended and rebased

Cash Flow Effects:

- Income Tax Effects: Acceleration in timing of revenue recognition may drive acceleration of income tax payments, affecting cash flow

- Compliance/Restatement Costs: One-time costs of achieving compliance and potential for increased compliance costs over time

- Compliance for Purchased Businesses: Increase integration expenses for a newly acquired target when the buyer or target has not yet adopted the new processes

Example of Revenue Recognition under Current Guidance versus New Guidance:

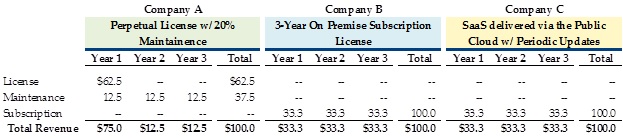

With current revenue recognition policies, subscription licenses in software are recognized ratably over the length of the contract. With perpetual licenses, vendors can achieve “Vendor Specific Objective Evidence” (VSOE), which demonstrates that the purchase of the upfront license is independent of any ongoing services. If a perpetual license contract achieves VSOE then the license portion of the revenue is recognized upfront – if VSOE is not achieved and thus it is not clear that the license is separate from the ongoing services, both the license revenue and the ongoing services revenue are typically recognized over time. In the illustration in Figure 1, Company A sells a 3-year perpetual license contract for $100 and achieves VSOE. This example assumes annual maintenance represents 20% of the license fee. If the Company A cannot achieve VSOE, revenue is recognized ratably, just like Company B and Company C.

Figure 1 – Accounting under Current US GAAP

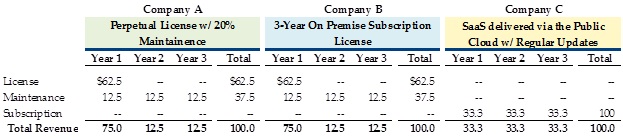

Under the new ASC 606 guidance, multi-year contracts and subscription licenses are decomposed into their constituent parts and much of the revenue will be required to be recognized up front – except the (potentially small) portion of the revenue associated with cost of delivering the ongoing services. Perpetual license vendors (Company A) will no longer need to demonstrate VSOE in order to recognize much of the revenue up front. In many cases, ASC 606 may result in companies being required to recognize much more revenue upfront than under the prior framework. In the example above, it is possible that under ASC 606 even a subscription license company may have to recognize most of the revenue upfront if the post contract services are valued at a small amount and recognized ratably as shown in Figure 2 (Company B).

Figure 2 – Accounting under ASC 606

ASC 606 may have less of an impact for truly cloud-delivered services (SaaS, Company C) than for on-premise subscription vendors. Since SaaS vendors provide much of the value over time as a service, they are more likely to be able to continue to recognize revenue ratably, whereas the on-premise subscription model will require a decomposition of the license from the services with the potential for a large part of the revenue to be recognized up-front.

In many cases, companies with on-premise subscription license models will see a meaningful decrease in deferred revenue that would otherwise be amortized in future periods, since this revenue will instead be recognized up front under ASC 606. The gain in upfront revenue will lead to potentially large short-term windfalls in EBITDA, amplified by some changes in the recognition of commission expense and only partially offset by the reduction in deferred revenue. For subscription license-based companies where revenue has to be recognized upfront under ASC 606, going forward earnings profiles may not be as “smooth” as they have been in the past.

For perpetual license companies transitioning to subscription licenses, if ASC 606 results in more revenue recognition up front, the typical “dip” associated with such a transition may be less pronounced. This may allow such transitions to be executed in the public markets without the same initial negative reactions from investors that companies such as AspenTech suffered in 2015. A rapidly growing, negative EBITDA company that is transitioning from perpetual licenses to subscription licenses may thus turn a profit sooner under ASC 606.

Most public companies are still evaluating the impact of ASC 606 but will need to come into compliance with their full-year 2017 financial statements, whereas many private targets may not have even begun evaluating the impact as they have another year to come into compliance. Buyers and targets will need to pay careful attention to these changes as they diligence and execute transactions in 2017 and 2018.