In August this year, Pfizer said that it would pay $14 billion for Medivation, a company that helps treat patients with prostate cancer. It was the latest in a string of acquisitions for Pfizer. As in some of Pfizer’s other deals, management touted the transaction as “immediately accretive,” saying it should add five cents a share to earnings in the first year.

Merger accretion – the bolstering of earnings per share following a deal – is something CEOs often trumpet to help solidify shareholder confidence in a union. Rather than applaud this aspect of Pfizer’s deal, however, Pfizer stockholders were underwhelmed. Shares didn’t budge following the announcement and are trading below Pfizer’s undisturbed price.

Pfizer’s management team isn’t alone in highlighting accretion benefits. Of the 31 US transactions over $1 billion announced in the past year, just under half said they would be accretive in the first year or earlier. Of those, less than half of the acquirers’ stocks have beaten returns of the S&P 500 since announcing a deal.

The trouble may lie, in part, with how deal math is muddied, often creating more confusion than clarity for shareholders and other decision makers like the company’s board and even management team. Companies and their investment banking advisors often conflate artificial earnings increases resulting from financial engineering with those that are a consequence of true economic value from cross-selling or cost rationalization. This mixing of factors can make companies that are paying too much for an asset look as if they are completing a good deal.

Management teams can easily fix this mistake by isolating specific merger benefits using an analytic tool we call “Constant Capital Structure” analysis. This analysis removes the boost a company receives from changing its capital structure and allows decision makers to offer a fairer assessment of a deal’s merits.

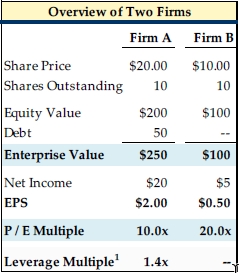

Consider this simple example where Firm A is buying Firm B. As the table below shows, A is larger than B in terms of overall value, and it earns four times as much. But A is buying B at a very rich price, twice A’s multiple.

(1) Calculated as Debt / EBITDA; assumes 5% interest on existing debt and 40% tax rate; for simplicity, assumes no capex or D&A.

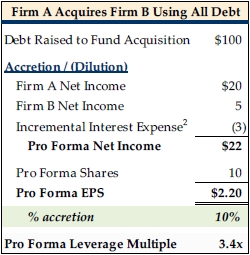

On the face of it, this transaction would appear “expensive”, because A is paying up to acquire B at a much higher multiple. However companies often justify these types of deals in part by showing “EPS accretion” that results from using low interest debt to finance the acquisition as shown in the table on the right on the following page.

In the table below, A is using debt to buy B. Assuming an interest rate of 5% and a tax rate of 40%, the after-tax interest payment nets out to $3. This interest payment is the only additional cash cost to Firm A, and the company’s share count stays the same. Firm A will also be adding $5 of earnings from Firm B.

(2) Assumes 5% interest rate on acquisition debt and 40% tax rate.

As a result of these added earnings being higher than the incremental interest payment, this transaction gives each individual shareholder more EPS. In any transaction where the interest costs associated with increased debt is less than the added earnings from the seller, the transaction will increase the acquirer’s overall EPS.

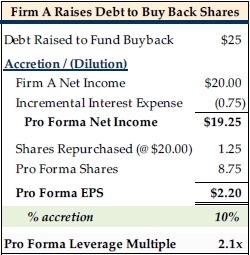

Whether achieving that accretion through a particular acquisition is the best decision for the company is another question. As the table below shows, a company can also achieve the same boost in its earnings simply by changing its capital structure. Here, Firm A raises $25 of debt, and it uses this cash to repurchase stock. With fewer shares outstanding, Firm A also boosts its EPS for shareholders just as much, and it doesn’t have the risk of executing a merger. Overall, its leverage level is much lower too than if it had acquired Firm B.

Both these examples ignore other benefits (and hidden costs) of a merger – specifically “synergies”, or the additional earnings a company can achieve by cross-selling products or rationalizing costs. Synergies are the main purpose of bringing companies together in the first place, and boards and shareholders should and do make this a key aspect of their consideration. But how to make sure that the analysis clearly isolates the impact of the deal benefits?

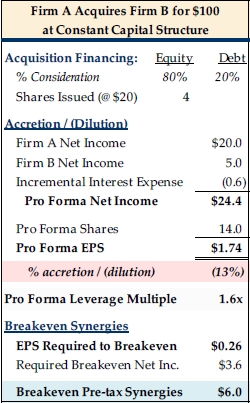

One approach management teams and their advisors could take is to show the specific synergistic benefits per share by using the Constant Capital Structure analysis mentioned above. This shows hypothetical math that is independent of – and doesn’t always reflect – the way in which the deal is actually financed. In doing so, it would allow a decision maker to evaluate the transaction benefits apart from the coincidental change in capital structure.

The table on the following page shows this analysis. Firm A’s mix of debt and equity stays the same both before and after the transaction. Firm A had $50 of debt, or a fifth of its total $250 value, as a standalone company. If it buys B, incremental debt would make up $20, or 20% of the purchase price.

Firm A has to issue stock as well. As a result of increasing shares and taking on incremental debt, the transaction based on M&A financial metrics will be dilutive. Take the math a step further, and in order for a transaction to be neutral to its overall earnings per share based solely on deal benefits, Firm A needs to be able to generate $6 in pre-tax synergies from the acquisition from earnings associated with either higher revenues or cost rationalization.

Alternatively, management teams and advisors can show the deal’s merits by clearly articulating and valuing the synergies they expect. The premium the acquirer pays to buy the seller should be at least the same as the synergies (put another way, price should be at most seller’s value plus the value of synergies.)

This latter point may seem obvious. But the value of synergies hasn’t been isolated in recent deals. Pfizer’s acquisition of Medivation is a good example. The company said the acquisition should be accretive in the first year. But Chairman and CEO Ian Read did not give a specific figure for synergies. When discussing the benefits of combining the companies, he spoke in non-numeric terms about revenue synergies and did not discuss cost synergies (perhaps because Medivation has roughly 700 employees, a small number considering its size, so any cost savings would be very modest.)

The Constant Capital Structure tool does have some analytical limitations. It only looks at earnings per share and does not address value overall. To determine the true effect on shareholder value, the analytical work must expand to include a judgment about the multiple at which the combined company will trade.

Typically the new expanded company will trade at a blended multiple of its parts, no matter the multiple the buyer pays for the seller. Depending on the earnings contribution from the seller, the multiples of the two standalone companies, and the premium, the new company can be less valuable overall despite that it has increased EPS, even including the impact of synergies. If management teams and boards don’t assume a fair post-deal multiple, applying an inflated one can also create an illusory good deal.

Management teams can protect themselves by taking this more conservative approach to transaction evaluation. It not only saves them from doing a deal for the wrong reasons, but can also put them in a better position to get a buy-in from shareholders. As a result, advisors should make a Constant Capital Structure analysis a routine part of their transaction evaluation. And managements, boards and ultimately shareholders should insist on it. Once the EPS accretion is presented absent financial engineering, shareholders can decide what multiple to apply to that EPS to value the stock.

The analysis will undoubtedly make deals look less attractive. But it will improve clarity, too. And for deals that clear this bar, companies will enjoy the support of a well‐informed shareholder base.