Candidate Trump ran a campaign vowing to make America great again; his presidency has adopted that goal as the driver of policy: MAGA! On multiple occasions since his upset election, President Trump suggested or indicated that the strength of the stock market is a measure of the country’s prospects. For instance, during an April 21st, 2017 Oval Office interview with President Donald Trump, AP White House correspondent, Julie Pace, indicated, “one thing that I think has been different about this White House is that you do point to the markets as a sign of progress.” Trump responded, “You live by the sword, you die by the sword, to a certain extent.” In a February 23rd, 2017 interview, CNBC’s Becky Quick asked Treasury Secretary Steven Mnuchin if he viewed the rally as a score card. Mnuchin replied, “Absolutely, this is a mark-to-market business, and you see what the market thinks.” Three years into President Trump’s term and on the day of a critical debate among his potential Democratic challengers, we set out to assess the record using the President’s and his Administration’s own yardstick. What emerges is striking and has important business and policy implications.

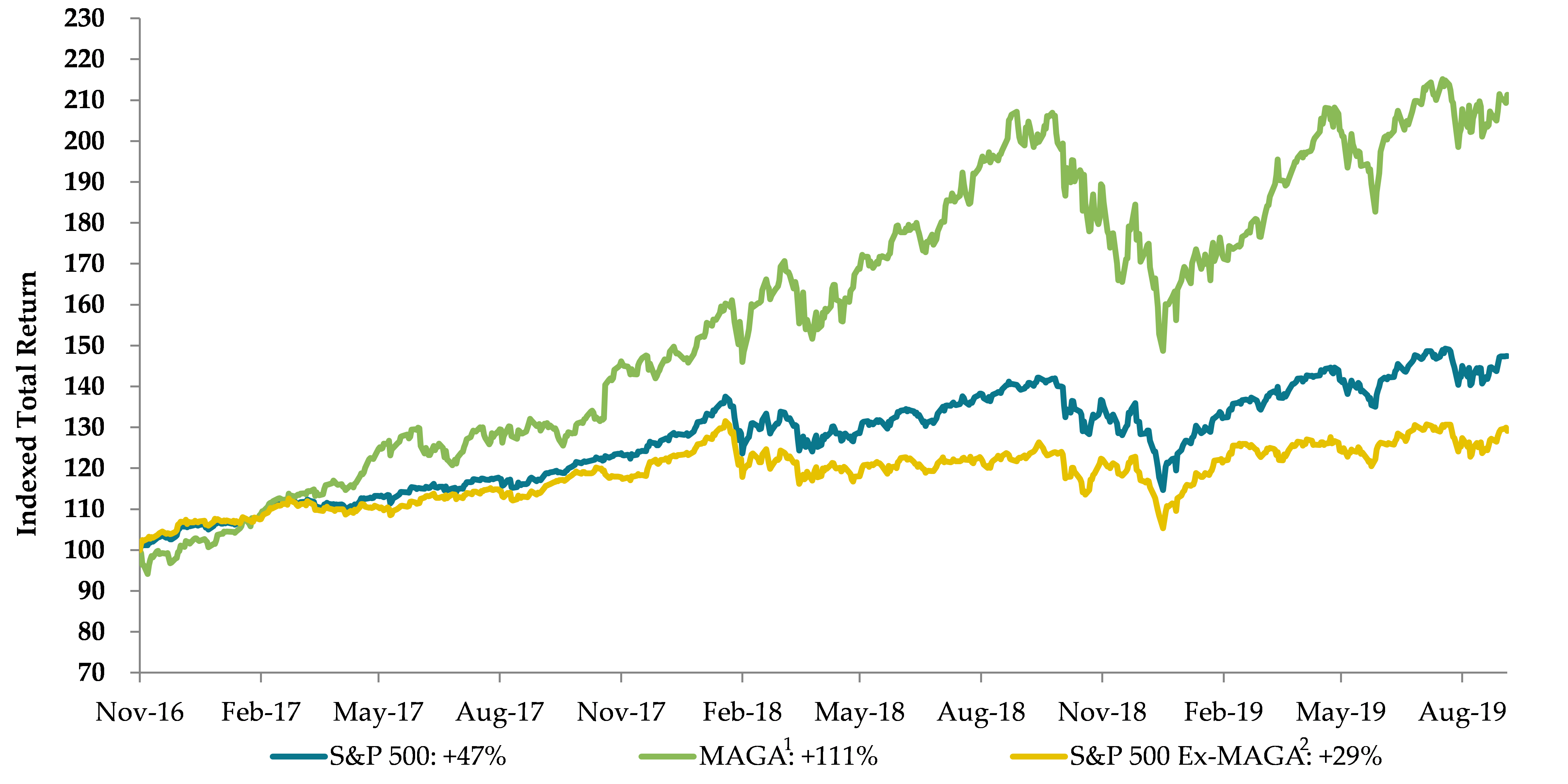

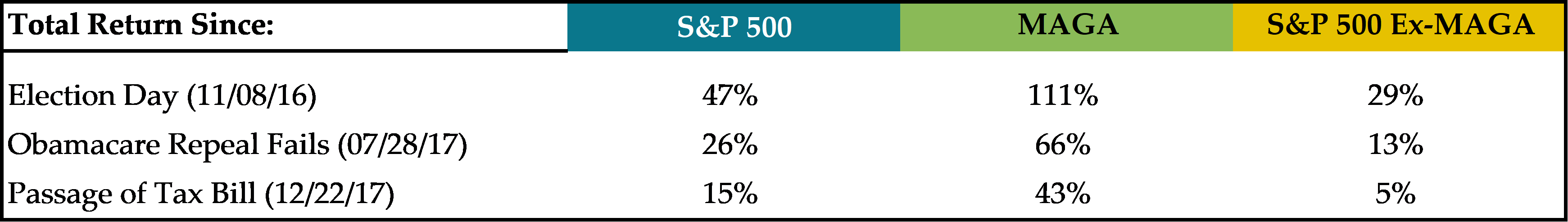

Since the November 2016 election, the markets, as measured by the S&P 500, have indeed had a strong total return (inclusive of dividends) of 47%. For a three year period well into one of the longest bull markets in history, that is a very respectable performance. But, and this is a very interesting but, the bulk of that return is attributable to just four stocks, also known endearingly as the Tech Giants and less kindly as the Tech Monopolists: Microsoft, Apple, Google and Amazon (the other MAGA). The story is indeed a tale of two cities; one city of market return have’s and one city of market return have not’s. The “monopolist” MAGA, given their unchecked dominance, returned 111% over this period while the rest of the index returned a more modest 29%.

The contrast between the two sets of returns is even starker if the starting point is shifted to July 28, 2017, the date on which the Trump Administration abandoned the effort to repeal Obamacare and shifted its priorities to a corporate tax cut. Since then, the MAGA stocks returned a whopping 66%, but the rest of the S&P 500 returned a mere 13%, the bulk of which is attributable to the earnings impact of the tax cut. Since the passage of the tax bill almost two years ago (12/22/17), the S&P 500 (ex MAGA) has had a negative return when adjusted for the earnings impact of the tax cut.

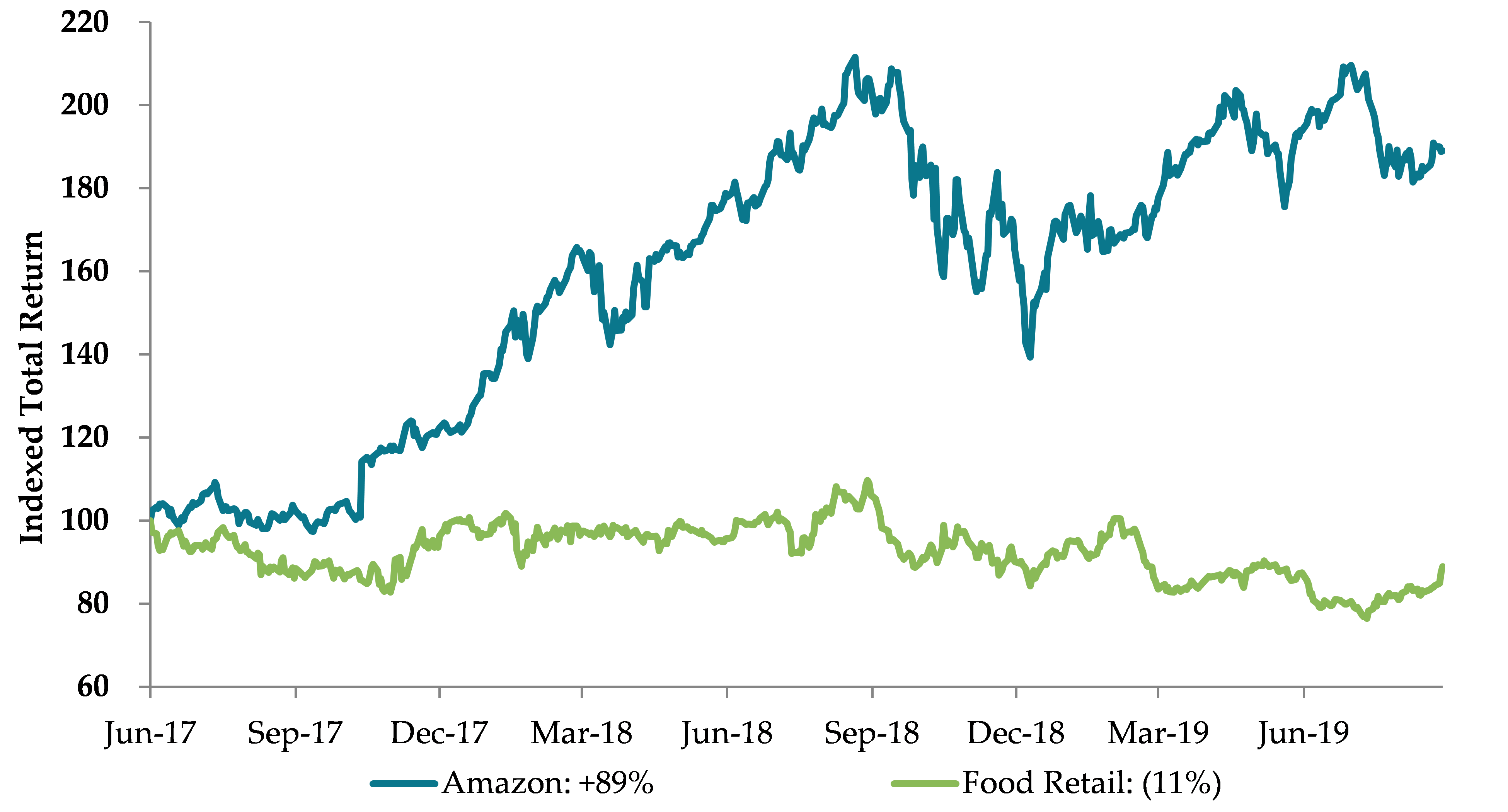

This MAGA outperformance is not as organic as it might initially appear: it is in part explained by the fact that the MAGA company dominance has gone unchecked and unchallenged in Washington, DC. Regulatory response, or total lack thereof, to Amazon’s entry into food retail is a case in point. Amazon has been massively disrupting all retail categories. In book retail, it has already driven much of the sector out of business. The broader retail sector, as measured by the SPDR S&P Retail ETF (adjusted to exclude Amazon), is only up 8% since Trump was elected President. On June 16, 2017, Amazon made a splashy entrance into food retail through its blockbuster $13.7 billion acquisition of Whole Foods. In light of Amazon’s track record of destroying competition before replacing it (note the announced ramping of Amazon bookstores), one would have expected some regulatory scrutiny of that acquisition. However, the acquisition sailed through regulatory review (within a fairly typical 60-day review period for noteworthy transactions and with no second request). The markets, of course, knew better about the impact of the acquisition on the competition: since the day before the deal announced, Amazon is up 89% while the food retail sector is down 11%[3]. The chart above showcases the diverging performance since the Whole Foods announcement.

There are signs that the reign of the tech monopolists is coming under pressure. The Justice Department and FTC appear to be focusing on the influence these companies yield, with both launching investigations into the MAGA companies in recent months. But we refrain from judgment. Our modest goal with this note has been to highlight the stock market “MAGA” dimension of a MAGA-driven administration, for the consideration of various economic actors and policy-makers. With the impact of tax cuts already fully factored in and the MAGA stocks cooling down, it will be interesting to see whether markets continue their appreciation and what drives that appreciation. President Trump has changed his campaign slogan to Keep America Great (“KAG”). Time will tell whether that goal will be satisfied with a flat market or whether we should be seeking a stock with the letter K to replace Amazon, maybe the food retailer Kroger?

[1] MAGA represents Microsoft, Apple, Alphabet (Google), and Amazon, the four biggest (by market cap) public companies in the world. MAGA total return is calculated as the market cap weighted total return of these four companies, which is the same weighting methodology as the S&P 500 total return.

[2] S&P 500 ex-MAGA total return is calculated as the S&P 500 total return less the market-cap-weighted MAGA total return index, rebased to 100.

[3] Based on the median total return performance of companies with SIC code 54, which represents food stores, that trade on a major US stock exchange. Constituents include Kroger, Casey’s General Stores, Sprouts Farmers Market, Weis Markets, Ingles Markets, UNFI, SpartanNash, Village Supermarket, Natural Grocers, GNC, Vitamin Shoppe, and Rocky Mountain Chocolate Factory.

Note: All market data as of close of market on 09/11/19. Total return indexed to 100 on close of market on election day of 11/08/16; assumes dividends reinvested.

Source: FactSet (09/11/19)