Executive Summary

Cash held overseas by U.S. companies has grown substantially over the past decade. The balance now stands at over $2.3 trillion and is growing(1). Companies use some of the offshore cash to fund daily overseas operations, some to invest in foreign projects, some to make acquisitions outside of the U.S. and some to hold in reserve prudentially for a rainy day. However, a potentially large portion of the $2.3 trillion sits idle for no good business reason other than delaying (perhaps indefinitely) the payment of associated taxes in the U.S. There is certainly a political and perhaps emotional element to this resistance to repatriate excess cash and pay associated taxes. From a purely shareholder value perspective, however, keeping truly excess cash abroad is value destructive: the very large negative spread between the interest earned by that cash and a company’s weighted-average cost of capital overwhelms any benefits of tax deferral or outright avoidance.

Description of Analysis and Summary Findings

U.S. companies keep cash abroad for business reasons and for tax planning. The business reasons that justify keeping cash overseas include funding and supporting everyday operations, investing in large projects, acquiring foreign companies and having a prudential reserve of liquidity. We consider “excess cash” any offshore cash that exceeds what U.S. companies need for businesses purposes. We offer a framework below for determining whether and when a company should repatriate that excess cash.

a. Repatriation decision without expectation of a tax holiday

Our framework starts with the cost / benefit analysis of repatriating excess offshore cash. The benefit of repatriation is the ability to deploy the after-tax capital to yield the company’s weighted-average cost of capital. This can be done through U.S. domestic investments or shrinking the company’s capital through a combination of share repurchases and debt retirement (in proportion to the company’s capitalization), which can only be carried out domestically. While weighted-average cost of capital varies by company, a representative large U.S. company has a weighted-average cost of capital in the 7% range(2) .

The cost to repatriate is the sum of the one-time tax triggered upon repatriation plus the foregone annual interest income on the total excess offshore cash balance. For purposes of this analysis, we assume that the repatriation tax rate is equal to the difference between the U.S. corporate tax rate of 35% and the foreign tax rate at which the company’s non-U.S. earnings have been taxed. We use 22% as an illustrative proxy for the foreign tax rate by weighting the foreign tax rates by the proportion of cash held in each jurisdiction for companies in the S&P 500(3) . In addition to this one-time tax of 13%, we also assume that excess offshore cash earns annual interest of about 1%(4) .

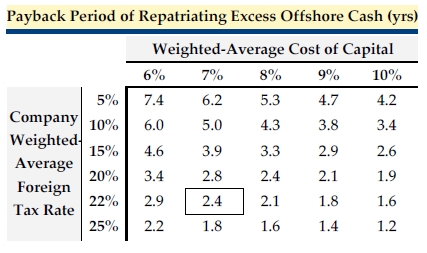

Under this analysis, the annual negative carry of keeping excess cash abroad is 6%: annual interest income of 1% minus the company’s weighted-average cost of capital of 7%. At a negative 6% carry, it would take a little over two years for the company to earn back the tax bill assuming a 13% differential between the company’s U.S. and foreign tax rates(5) . The chart below shows the payback period at different tax rates on foreign earnings and at different weighted-average costs of capital, assuming 1% interest on overseas cash. Many companies have foreign effective tax rates well below 22% and many companies have a weighted-average cost of capital above 7%.

The timeframe matters because a short payback period puts the focus on the urgency to repatriate to create shareholder value, whereas a longer period creates some flexibility to wait for either higher foreign interest rates or foreign investment opportunities that are not visible today. However, waiting is not costless: our analysis clearly shows that there is currently a roughly 6% annual cost to that wait, which is a significant cost in anticipation of opportunities that have not been specifically identified.

b. Repatriation decision in anticipation of potential tax holiday

The other component of the repatriation decision is the prospect of a U.S. tax holiday. That anticipation naturally tempts U.S. companies to hold out for repatriation. There is precedent for such a holiday. In 2004- 2005, the U.S. government allowed all U.S. companies to repatriate offshore cash at a flat 5.25% tax rate. To the extent a U.S. company thinks another tax holiday is unlikely in any circumstance, the analysis above is unaffected. Otherwise, the sooner a company expects the tax holiday to be implemented and the lower a company thinks the one-time tax rate will be, the more likely that company will want to wait.

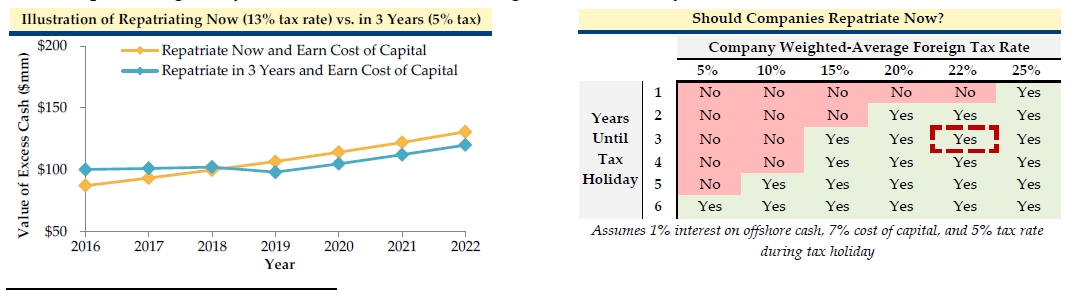

A framework that factors in these expectations is as follows. We assume, for purposes of analysis, that a U.S. company would take advantage of a tax holiday if and when it were implemented. Continuing the example referenced above, a company that repatriates $100 million of excess offshore cash today will pay $13 million of taxes and subsequently earn 7% annually, through a combination of domestic investments at the company’s weighted-average cost of capital, share repurchases yielding an annual return on equity and annual savings on interest expense following debt repayment. If the company believes a tax holiday will occur in three years at the same 5% tax rate as in the prior holiday, it will earn 1% interest on offshore cash for three years, incur $5 million of taxes, and then subsequently earn 7% annually. The comparison between the two paths is shown in the chart below on the left, demonstrating that repatriating is favorable under these assumptions. The table on the right illustrates a decision framework for repatriation timing, and it demonstrates the assumptions under which repatriating today is more favorable to waiting for a tax holiday.

Explanation for Findings

What might explain why companies are not repatriating cash? One possible explanation is that companies are simply averse to paying taxes at a higher rate than otherwise offered during a potential tax holiday, particularly given the historical precedent. Companies might be holding out to make a tax holiday or a reduction of the U.S. corporate tax rate more likely. The above analysis shows that such resistance has been and continues to be very costly from a shareholder perspective.

A second possible explanation is that some U.S. companies are approaching the repatriation decision under a misguided framework. Certain U.S. companies may evaluate the optimal means of funding domestically a share repurchase program, for example, and determine that issuing bonds in the U.S. at a 3% pre-tax cost of debt outweighs the net benefit of repatriation. However, an isolated debt issuance does not alter a company’s overall weighted-average cost of capital. Offshore cash, when repatriated, can be deployed across the capital structure to both debt and equity, at the weighted average cost of capital, so the comparison to an isolated debt financing is not appropriate. Rather, the appropriate comparison is to the overall weighted-average cost of capital.

Indeed, there are companies that have started to realize the benefits of repatriating offshore cash despite the potential tax bill. Within the past two years, there are several notable examples of such repatriation. In April 2014, eBay repatriated $9 billion and paid the $3 billion of tax associated with repatriation; while the company did not have an explicit use for the cash upon bringing it home, the company cited a number of potential means of deploying the capital, including acquisitions and other meaningful organic investments. In October 2014, Stryker brought back $2 billion to make acquisitions, fund its dividend, and repurchase shares, also paying the full tax bill. Teleflex and Apache repatriated cash to pay down debt and to further grow their domestic businesses. Manpower routinely repatriates offshore cash. Other companies that have repatriated offshore cash, albeit tax-efficiently using credits accumulated over time, include Verisign and Duke Energy.

Summary Implications

The opportunity cost of letting excess offshore cash sit idle is greater than the tax bill associated with repatriation, and the payback period is short. Barring aggressive assumptions on the timing of a potential tax holiday, repatriating excess offshore cash immediately generates more shareholder value than waiting.

None of this is meant to obviate the need for corporate tax reform. But in most circumstances, the rational advice to a U.S. company with a large excess cash balance abroad is to repatriate that cash immediately and deploy it to U.S. projects yielding at least the company’s weighted average cost of capital or return it to shareholders via a buyback or deleveraging.

Footnotes:

(1) The $2.3 trillion figure is the sum of 2015 ending offshore cash balances of S&P 500 companies per Bloomberg data.

(2) The 7% weighted average cost of capital is calculated under the following formula: WACC = Cost of Equity times percentage of equity in total capitalization plus the after tax Cost of debt times percentage of debt in total capitalization. In calculating cost of equity, we use a 2.2% risk-free rate based on the U.S. 20-year treasury yield as of 04/14/16, a 6.1% market risk premium per Ibbotson and levered beta for the S&P 500 of 1.0; in calculating after tax cost of debt, we use a pre-tax cost of debt of 4.0% based on the 1-year average 5-year U.S. corporate BBB effective bond yield and a 35% tax rate; we assume 20% debt to total capitalization ratio, which is the median capitalization ratio of the S&P 500 per FactSet.

(3) Based on current cash holdings by jurisdiction for S&P 500 companies per Bloomberg and tax rates by jurisdiction per KPMG.

(4) 1% interest income on overseas cash is approximated using the euro area 10-year government benchmark yield per the ECB.

(5) If $100mm of excess cash is left offshore earning 1% interest, the balance would be $102mm after 2 years. If the $100mm were repatriated today, the company would pay $13mm of taxes and then return 7% annually, which would be $100mm after 2 years.